Business Insurance in and around Pueblo

Pueblo! Look no further for small business insurance.

No funny business here

Help Protect Your Business With State Farm.

Do you feel like there's so many moving pieces and it's hard to keep it all straight when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Ronnie Romero help you learn about excellent business insurance.

Pueblo! Look no further for small business insurance.

No funny business here

Insurance Designed For Small Business

Whether you are an electrician a drywall installer, or you own a dance school, State Farm may cover you. After all, we've been doing it for almost 100 years! State Farm agent Ronnie Romero can help you discover coverage that's right for you and your business. Your business policy can cover things such as loss of income and extra expense and business property.

At State Farm agent Ronnie Romero's office, it's our business to help insure yours. Call or email our wonderful team to get started today!

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

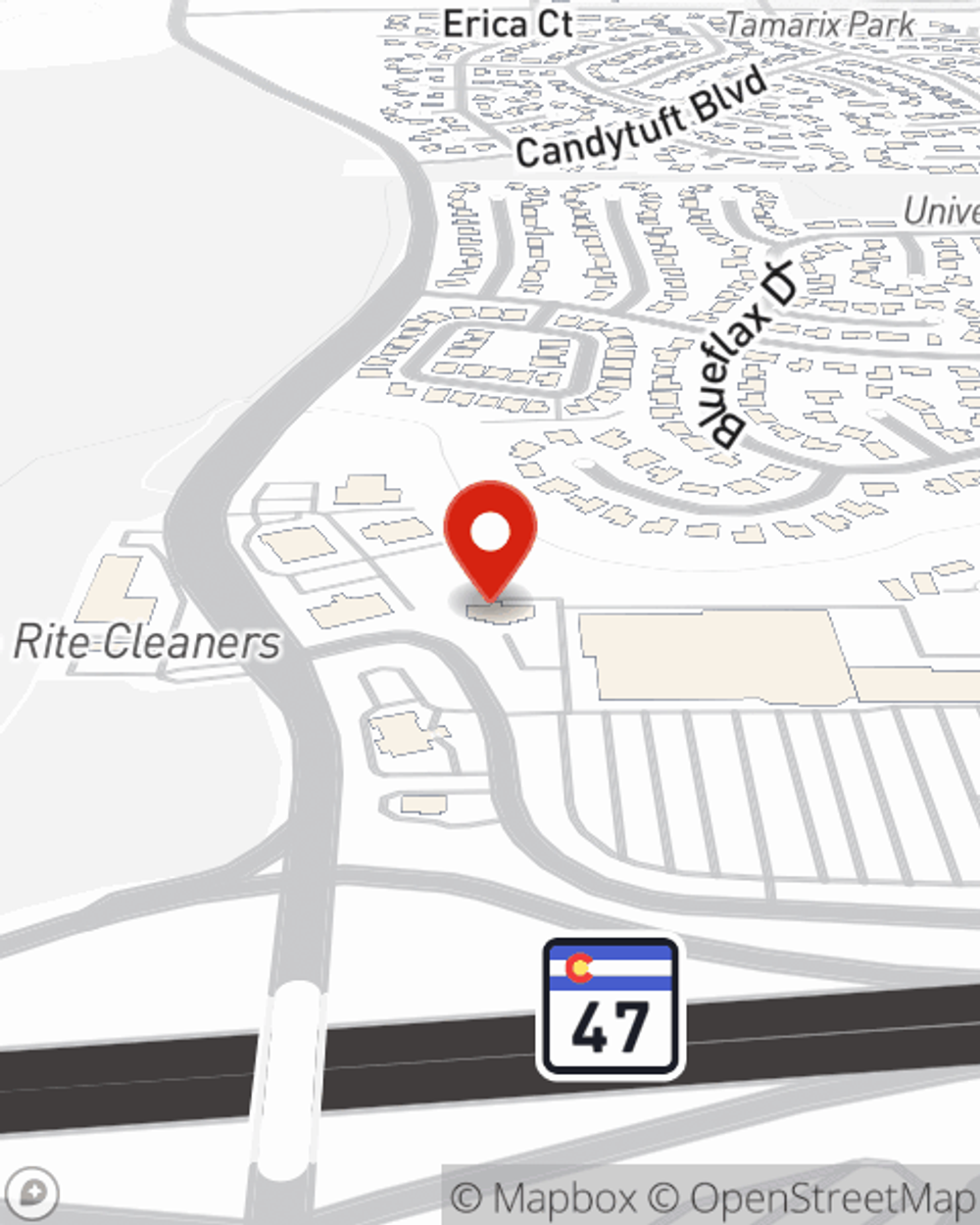

Ronnie Romero

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.